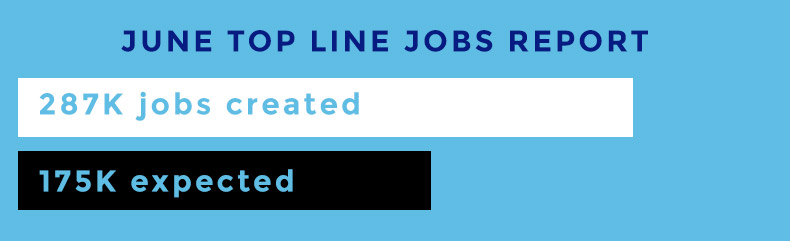

Rates remain at historical lows, and given the negative interests globally, US government bond yields are still high relative to global bond yields in Europe and Japan. On the jobs front, the month of June saw 287K jobs created in June versus the expected 175K with total unemployment at 4.9%, a slight rise from May. Within the jobs report, the closely followed U6 number fell to 9.6% from 9.7%. The U6 number is calculated by adding up the total unemployed plus all people marginally part of the labor force, plus total employed part-time as a percentage of the total civilian labor pool. This number is closely followed by economists. The labor force participation rate edged up to 62.7% from 62.6%, but is down significantly from the last decade and remains at multi-decade lows.

Banks are feeling the pinch with the compressing of the yield curve, as well as with the extraordinary low interest rates both domestically and abroad. Near-zero and negative interest rates are also affecting pension funds and insurance companies as it’s becoming more difficult to find yields to match long-term obligations. Banks are very hesitant to lower rates further since deposit rates are so close to zero, and they can no longer maintain deposit spreads.

While it would not surprise us to see movement in the 10-year US Treasury yield either up to 1.550% or down to 1.250% from the current yield of 1.374%, we are aggressively advising clients to lock in interest rates at these levels.